overview

|

The information below is provided for informational purposes only. The application process, laws, and regulations may change at any time. Current information can be found on the SCDOR website.

|

Getting a temporary Special Event License can seem daunting, so we have compiled some resources to help you navigate the process! Use the comparison chart below to determine what type of license you need.

All license-holders must:

If you are applying on behalf of a nonprofit, the organization must:

If you intend to host a multi-day event or an event with multiple locations, you may include those dates and locations on the same application. Including multiple events on one application enables you to transfer alcohol among those event locations and event dates. TBPs (Beer & Wine Special Event Permits) and TLPs (Liquor Special Event Permits) are limited to 14 days. TNLs (Special Nonprofit Event Permits) are 72 hours. If your event spans multiple counties, you must acquire a license for each county.

All license-holders must:

- Purchase their alcohol from a licensed wholesaler (not a retail store.)

- Have a valid South Carolina Sales Tax Retail License (apply here for a new tax license.)

- If you are charging admission for an event and offering any kind of entertainment, you will also need an Admissions Tax License.

- Be an LLC, Corporation, Sole Proprietorship, or Non-Profit that has been established for at least 30 days before applying for the license.

If you are applying on behalf of a nonprofit, the organization must:

- Be a nonprofit association, organization, or corporation chartered by the South Carolina Secretary of State's Office.

- Have a definite method of electing individual members to the organization. This method must be described in the group's bylaws and relate to the organization’s purpose.

- Be maintained through the payment of board/membership dues.

- Be managed by a board of directors, executive committee, or similar governing body chosen by the members at a regularly-held meeting on at least an annual basis.

- Have no member or shareholder of the organization benefiting from the organization’s net earnings.

- Collect all earnings from the event. A for-profit may not collect earnings on behalf of the nonprofit.

If you intend to host a multi-day event or an event with multiple locations, you may include those dates and locations on the same application. Including multiple events on one application enables you to transfer alcohol among those event locations and event dates. TBPs (Beer & Wine Special Event Permits) and TLPs (Liquor Special Event Permits) are limited to 14 days. TNLs (Special Nonprofit Event Permits) are 72 hours. If your event spans multiple counties, you must acquire a license for each county.

Requirement |

Beer & Wine Special Event Permit (TBP) |

Liquor Special Event Permit (TLP) |

Special (Donated) Nonprofit Event Permit (TNL) |

Allows you to sell |

Beer & Wine |

Beer, Wine, & Liquor |

Beer, Wine, & Liquor |

Allows you to solicit alcohol donations^ |

NO |

NO |

YES |

License can be issued to |

Corporations, Sole Proprietors, & Nonprofits |

Nonprofits only |

Nonprofits only |

License can cover a period of |

15 consecutive days |

15 consecutive days |

72 consecutive hours |

# of licenses that can be issued per calendar year |

Unlimited |

Unlimited |

4 |

Allows you to transfer unused alcohol to another event or resell it to another organization |

NO |

NO |

NO |

Cost *excludes costs of organization formation & taxes |

$10 per day |

$45 per day |

$40 per day |

Application Packet |

^ = You may only solicit alcohol donations from a licensed wholesaler or manufacturer. You may not solicit donations from restaurants, bars, or retail stores. Breweries & Brewpubs may donate if their beer is delivered through a wholesaler.

application Documents

Once you have established the type of license you need, the next step is to assemble your application packet. Submit these documents alongside your application:

1. Applicant Information: Who is applying for the license?

2. IRS FEIN Registration: You must know your organization's FEIN number to apply for an alcohol license.

3. SC Secretary of State Registration: Unless you are a Sole Proprietorship, the organization applying for the license must be registered with the SC Secretary of State for at least 30 days before applying. Nonprofits must be chartered with the state of South Carolina but are not required to have an IRS Tax Exemption status.

4. Tax Licenses: You must provide your Retail Sales Tax License number, and if you plan to charge admission to your event, you must also submit your Admission Tax License number. Be prepared to remit the appropriate sales taxes after the event. Nonprofits may qualify for sales tax exemption.

5. Venue Lease/Property Map: If you lease a venue with a permanent license, you must provide a copy of your rental/lease agreement. If you only rent a portion of their event space, you will need a map that outlines your event boundaries versus the rest of the property. Only one license per location can be active at a given time, and this map will indicate the area each one covers.

If you are applying as a nonprofit and plan to have other vendors on-site selling goods during the event, you will need an event site map that indicates their locations. If you are selling liquor at the event and other vendors are present, you must be able to define boundaries to keep liquor sales and consumption away from other vendors. You cannot have outside vendors selling goods in an area where liquor is being consumed or sold.

6. Law Enforcement Notification: The Police Chief or Sheriff for your event's jurisdiction must complete this ABL-100 form. If you're unsure of your event's jurisdiction, visit this website. Fill in your portion of the ABL-100 form and drop it off with the rest of your application packet at the appropriate law enforcement office at least two weeks before the event. Be sure to leave your name and phone number so the office can contact you once the form is ready. Some departments may allow you to email it for completion, but others require you to drop it off and pick it up in person.

7. Event Times: You must indicate your event times on the Law Enforcement Notification and ABL Application. We recommend adding a one-hour buffer on either side of your event. You may not serve anyone outside of the licensed event times. A buffer gives you leeway to serve early arrivals and to extend the party if needed.

1. Applicant Information: Who is applying for the license?

- If the application is for a business or Sole Proprietor, the CEO, President, or Lead Event Organizer must complete the license application.

- If the application is for a nonprofit, the application should come from a Board Chair or Executive Director. This individual is legally responsible for complying with all the regulations that pertain to the license application and alcohol operations of the event.

- This individual also:

- Must have been a South Carolina resident for at least 30 days.

- Must not owe delinquent taxes, penalties, or interest.

- Must have a good moral character with no criminal history related to crimes of moral turpitude.

- Must submit a background check;

- If the individual has lived in SC for two years or more, submit a Criminal Records Check from South Carolina State Law Enforcement Division (SLED). The check is valid for 90 days and may be used for multiple applications within 90 days. This kind of check costs $26.00, and charitable organizations that meet requirements set forth by state statute are eligible for a reduced fee of $8.00.

- If the individual has lived in SC for less than two years, they must submit a statewide Criminal Records Check from their previous state of residency and SLED.

2. IRS FEIN Registration: You must know your organization's FEIN number to apply for an alcohol license.

3. SC Secretary of State Registration: Unless you are a Sole Proprietorship, the organization applying for the license must be registered with the SC Secretary of State for at least 30 days before applying. Nonprofits must be chartered with the state of South Carolina but are not required to have an IRS Tax Exemption status.

4. Tax Licenses: You must provide your Retail Sales Tax License number, and if you plan to charge admission to your event, you must also submit your Admission Tax License number. Be prepared to remit the appropriate sales taxes after the event. Nonprofits may qualify for sales tax exemption.

5. Venue Lease/Property Map: If you lease a venue with a permanent license, you must provide a copy of your rental/lease agreement. If you only rent a portion of their event space, you will need a map that outlines your event boundaries versus the rest of the property. Only one license per location can be active at a given time, and this map will indicate the area each one covers.

If you are applying as a nonprofit and plan to have other vendors on-site selling goods during the event, you will need an event site map that indicates their locations. If you are selling liquor at the event and other vendors are present, you must be able to define boundaries to keep liquor sales and consumption away from other vendors. You cannot have outside vendors selling goods in an area where liquor is being consumed or sold.

6. Law Enforcement Notification: The Police Chief or Sheriff for your event's jurisdiction must complete this ABL-100 form. If you're unsure of your event's jurisdiction, visit this website. Fill in your portion of the ABL-100 form and drop it off with the rest of your application packet at the appropriate law enforcement office at least two weeks before the event. Be sure to leave your name and phone number so the office can contact you once the form is ready. Some departments may allow you to email it for completion, but others require you to drop it off and pick it up in person.

7. Event Times: You must indicate your event times on the Law Enforcement Notification and ABL Application. We recommend adding a one-hour buffer on either side of your event. You may not serve anyone outside of the licensed event times. A buffer gives you leeway to serve early arrivals and to extend the party if needed.

application steps

Once you've gathered everything, log into MyDorway to apply for your license. SCDOR recommends submitting your application at least three days before the event. We recommend at least two weeks, as you cannot place your alcohol orders without your license.

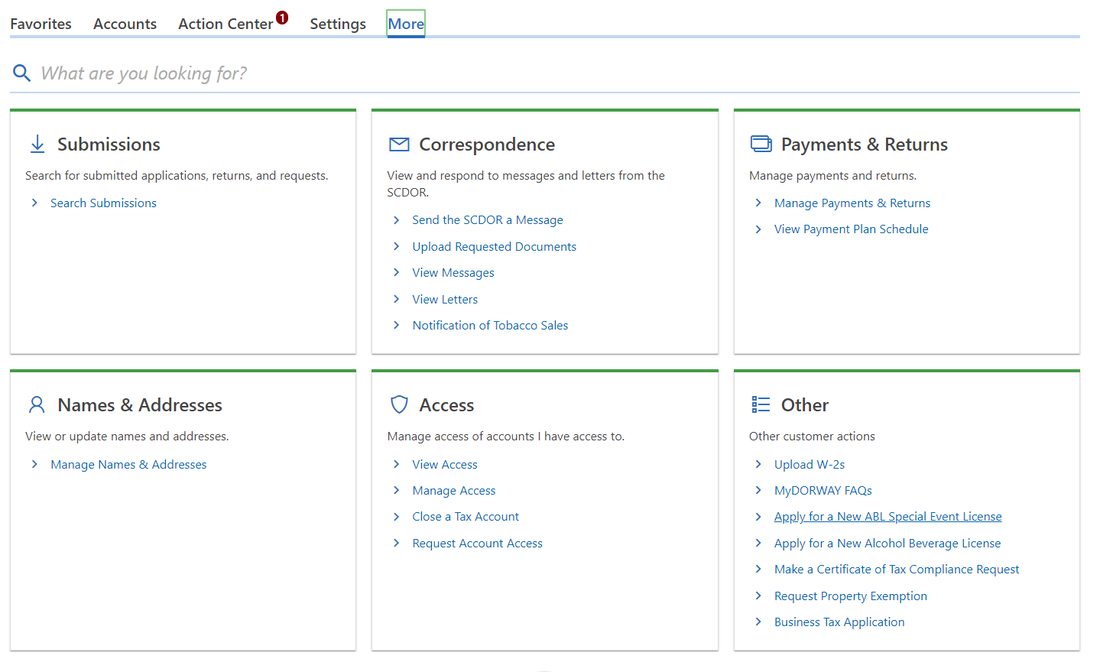

Step 1: Log into MyDorway. Select More > Other > Apply for a New ABL Special Event License. Follow the steps as outlined.

Step 1: Log into MyDorway. Select More > Other > Apply for a New ABL Special Event License. Follow the steps as outlined.

Step 2: You must notify SLED of the event before the permit can be issued by emailing [email protected]. Your email should include your name, your organization’s name, and the type, address, date, and time of your event. Copy [email protected] on the email.

Step 3: Once your application is approved, usually within 1-4 business days, you will be able to pay and print it on MYDORWAY. You will need to have a copy of the license posted publically at your event.

Step 3: Once your application is approved, usually within 1-4 business days, you will be able to pay and print it on MYDORWAY. You will need to have a copy of the license posted publically at your event.

Ordering & operations

Ordering: Once you have your license, you may order alcohol through a licensed wholesaler. You may not purchase alcohol through a retail store.

Safe Service: To ensure the safety of your event guests and reduce your organization's risks, we recommend enforcing the following Safe Service guidelines:

Security: Prepare an adequate security plan for your event. Hire a security company experienced in event management and well-trained to handle alcohol-related incidents, like Bravo1 Protection. You should:

- Remember, you cannot return leftovers from your event to the wholesaler or sell them to another person or organization. Calculate your portions as accurately as possible before placing your order.

- A wholesaler may deliver alcohol to your event site up to three days beforehand. Store all alcohol in a secure location.

- Some wholesalers will allow you to pick up your alcohol from their warehouse in advance, especially for smaller orders.

- To keep things simple, order from no more than two separate wholesalers.

- All alcohol must be paid for upon delivery or pickup via check. You may not use credit cards.

Safe Service: To ensure the safety of your event guests and reduce your organization's risks, we recommend enforcing the following Safe Service guidelines:

- Utilize the services of an experienced bar service instead of relying on volunteer bartenders. Make sure the bartenders have had alcohol safety training and know how to recognize signs of over-intoxication.

- Do not serve shots.

- Keep all liquor pours between 1.25 and 1.5 ounces.

- Only allow guests to order up to two drinks at a time. At last call, reduce the limit to one.

- Do not allow guests to self-serve.

- Limit the amount of tasting and sampling stations. Ask the staff at any such station to pour small cocktails instead of shots. Any shots should be no more than half an ounce.

- Don't understaff your bar. If your bar is understaffed, bartenders will feel pressured to serve guests too quickly and may be unable to engage long enough to notice signs of over-intoxication.

Security: Prepare an adequate security plan for your event. Hire a security company experienced in event management and well-trained to handle alcohol-related incidents, like Bravo1 Protection. You should:

- Have a security officer patrol the event site and monitor for signs of over-intoxication. It is easy for someone to get a drink from a friend without visiting the bar, and your bartenders cannot monitor every situation.

- Place an officer at each entry and exit point. They will:

- Ensure everyone who enters your event has been ID'd, and

- Make sure intoxicated guests have a safe way to get home.

- Authorize security to safely remove intoxicated guests so they cannot continue drinking alcohol.

- Establish a solid ID check process. Ideally, security should check IDs at the door and place wristbands on guests who are old enough to consume alcohol. Utilize paid security staff to do ID checks since they are trained to spot fake IDs and won't give wristbands to a friend.

insurance

Even though SC doesn't require event hosts to carry liquor liability insurance, we advise anyone hosting an event with alcohol to secure a liquor liability and general liability insurance policy. Liquor liability insurance refers to all types of alcohol, not just liquor. Even if your event features only beer and wine, you should purchase a liquor liability policy. A commercial insurance broker can help with this, or you can get a policy online through one of the below providers;